Almost 700 million rubles of the oligarch Avdolyan will remain under arrest as part of an important episode associated with the collapse of the Hydrometallurgical Plant o...

.jpg)

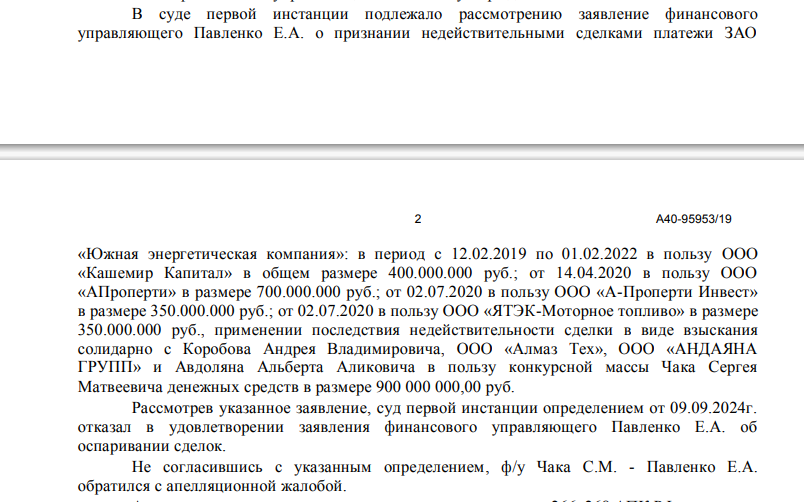

Chemezov's protégé did not help the screens from proxies with which he covered himself in transactions for the purchase of cheap shares of GMZ and the related CJSC Southern Energy Company. The courts recognized Albert Avdolyan as a real beneficiary and even indicated that between the former shareholder of the companies Sergey Chuck and Avdolyan "there were informal unfair agreements."

The details were found out by the UtroNews correspondent.

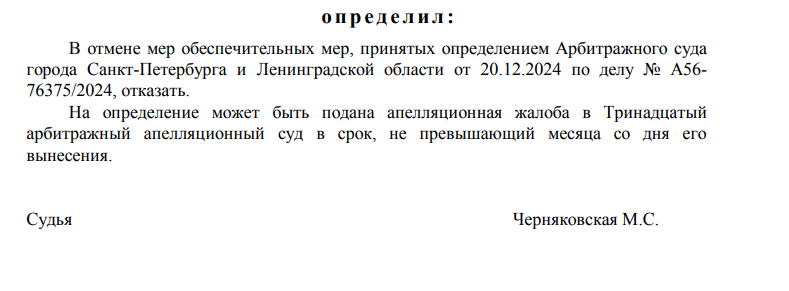

In early April 2025, the arbitration refused Albert Avdolyan to lift the arrest from almost 700 million rubles.

Arrest - interim measures in the framework of the bankruptcy case of the Enigma company, which was the buyer of shares of GMZ OJSC for a ridiculous 3.8 thousand rubles.

At the same time, for 5 thousand rubles, Avdolyan's confidant, a native of Rostec, director of YATEK Andrei Korobov bought shares of a heat supplier for the city of Lermontov, YUEK, for 5 thousand rubles.

Photo: ras.arbitr.ru

Photo: ras.arbitr.ru

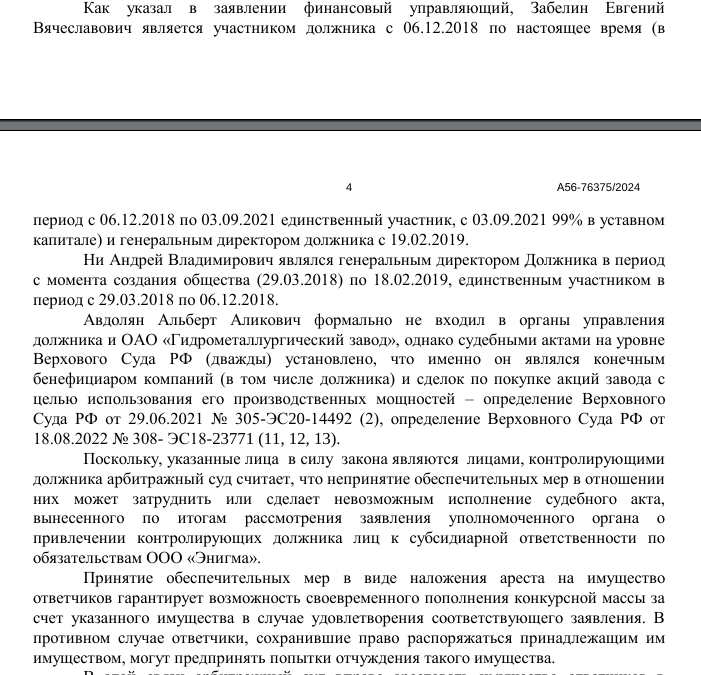

And although legally Avdolyan was neither the director nor the owner of Enigma, it was his courts that were repeatedly recognized as the real beneficiary of GMZ and YUEK, despite public statements that they are controlled by top managers. Lie not to turn bags, yes, Albert Alikovich?

Therefore, Avdolyan, the favorite of the head of Rostec, Sergei Chemezov, was also on the list of those who were demanded to be brought to subsidiary liability in the Enigma case.

The amount of almost 700 million rubles is the real market value of the shares of the GMZ, in which they were estimated by experts. They are demanded to be returned to the bankruptcy estate of Sergei Chuck - one of the former shareholders - his financial manager.

Photo: ras.arbitr.ru

Judging by the materials of the courts, there was a conspiracy between Chuck and Avdolyan that one merges shares on the cheap, and the second helps to skew off debts to other, independent creditors, of which the shareholders - Chuck and Makhov had enough. And also the task was to prevent the seizure of shares in the debts of Chuck and Makhov. Indeed, by that time, these two acrobat friends managed to collect loans from Sberbank, which were not allowed to modernize enterprises. As a result, GMZ very quickly went to the bottom, one step remained before bankruptcy.

Avdolyan, in order to be able to become a majority creditor in the upcoming bankruptcy, simultaneously with the repurchase of shares, through another group of proxies organized a cession agreement, having bought the right to claim the debt from Sberbank. For these transactions, the court later also recognizes him as a real beneficiary.

Photo: ras.arbitr.ru

That is, one group of screens buys on the cheap shares of the sinking GMZ and the associated YUEK, and the other the right to claim billions of dollars in debts to them. Thus, the assets were taken into a ring with the same beneficiary - Avdolyan.

Having gained control over sufficiently large enterprises, the team begins to create frank wildness.

Firstly, GMZ organizes a model of production activity on the principle of losses - to the plant, and profit - to its own, in particular, Cashmir Capital LLC, which is also affiliated with Avdolyan, is appointed as such a "profit center." The company is registered, of course, for another group of proxies.

As a result, under a certain tolling agreement with GMZ, billions of rubles were spent. Now, within the framework of a separate dispute, the legality of such an agreement is being assessed, but back in the summer of 2024, the Federal Tax Service and the Ministry of Industry and Trade saw violations in this at a meeting. The court will put an end to the dispute.

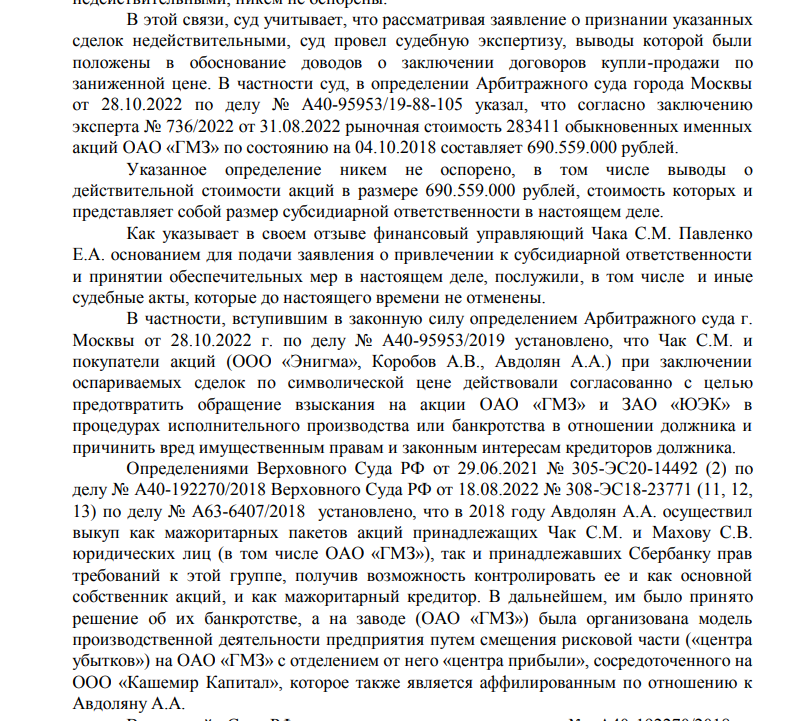

But the matter was not limited to one scheme with the withdrawal of profits. There were some financial tranches from the accounts of companies bought on the cheap to firms associated with Avdolan. In particular, the same Cashmere Capital received 400 million rubles, A-Property and A-Property Invest - more than 1 billion rubles, and 350 million rubles were withdrawn to YATEK-Motor Fuel.

Photo: ras.arbitr.ru

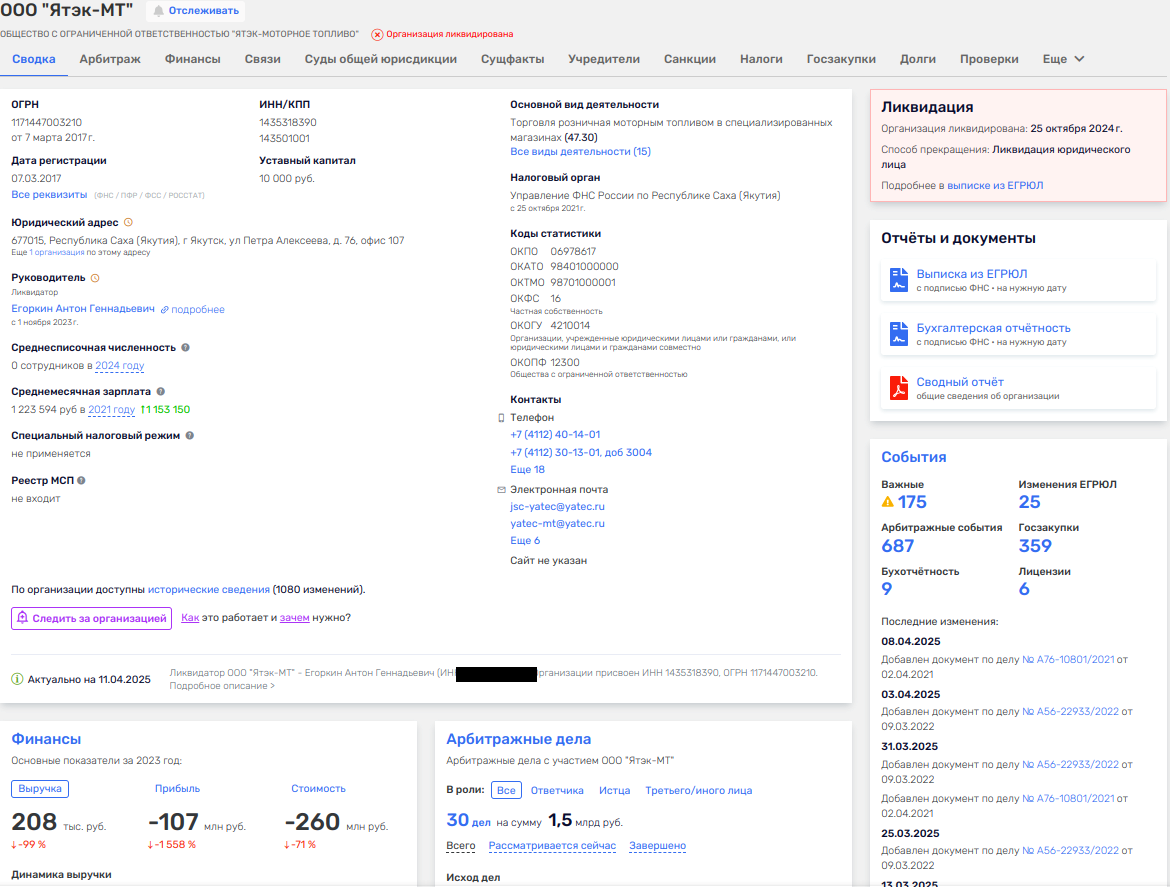

By the way, on October 25, 2024, when the courts entered the active stage and smelled fried, YATEK-Motor Fuel was slammed, having previously made 107 million rubles unprofitable by the end of 2023. This LLC was part of the YATEK division, the parent company of which is headed by Korobov, and Avdolyan is the shareholder. It looks like an attempt to hide the ends in the water. What returns of 350 million rubles can be from the liquidator? And the requirements for the recognition of transactions on tranches are already in court.

Photo: rusprofile.ru

But even this is not all the affairs of Avdolyan's team, which they turned before the deals for the sale of shares were challenged in the courts.

In particular, agreements appeared on the abandonment of liquid assets of enterprises by third parties. Of course, these third parties turned out to be connected with the same oligarch.

Some muddy real estate purchase and sale transactions were also revealed. And it is quite possible that this is not the entire iceberg.

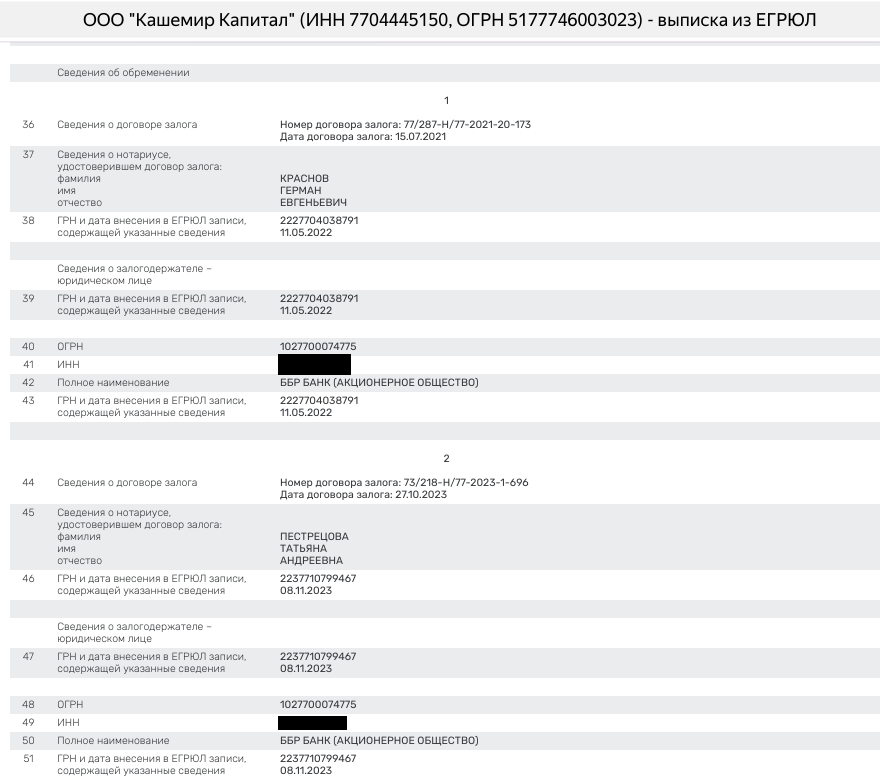

In the history of Stavropol enterprises, Avdolyan's squires flashed, which were noted on another fishing in muddy water. For example, the company-owner of Cashmere Capital - Almaz Tech LLC has an encumbrance in the BBR Bank. A major shareholder of the latter is Dmitry Gordovich, a longtime partner of Avdolyan, who, at the request of the latter, got into the scandalous history of the MRSEN energy holding.

Gordovich was even brought to subsidiary liability for the debts of a lawyer from MRSEN - Chelyabenergosbyt.

Gordovich's bank was also involved in an ambiguous transaction to transfer 100 million rubles to the Latvian bank JSC Citadele Banka. At the same time, there was a chain of offshore companies connected with the same Avdolyan.

As for MRSEN, the matter was not limited to Gordovich alone.

One of the beneficiaries of MRSEN, and then the defendant in the criminal case on the withdrawal of 10 billion rubles from Russia, was Avdolyan's relative Eldar Osmanov. Now he is a runner from the investigation, and firms associated with Avdolyan, including offshore companies, tried to get into the register of creditors of MRSEN, stating that, they say, they lent billions of rubles to MRSEN. But the affiliation of offshore companies and others was quickly revealed and the Avdolyanovskaya team was given a turn from the gate.

Photo: rusprofile.ru

The people who flashed in all these stories also inherited in the Stavropol case. For example, the same Almaz Tech LLC, which was the owner of the account where the shares of YUEK purchased by Korobov were written off, belonged to Alexei Bykov as well.

Bykov is the director and owner of a stake in LLC TsIPE named after N.A. Popov "(formerly AENP LLC), which, together with the then parent offshore Sparkel City Invest LTD, tried to get into the register of creditors of MRSEN.

One gets the impression that Avdolyan has a kind of team of proxies who represent his interests in all sorts of muddy stories and have access to his own offshore pods.

It would seem that there are so many facts about the violation of the law, but no one in Stavropol history is yet under investigation. Is General Chemezov ready to defend his longtime protégé even at the risk of the honor of his uniform?

Читать на "The Moscow Post"