Businessman Alexander Amosov, close to the oligarch with great ambitions and ambiguous reputation Albert Avdolyan, can get a share in the Russian business Tikkurila....

Amosov, from whose back Avdolyan's ears stick out, was probably involved in the deal to be approved by a government commission. Indeed, behind Avdolyan himself looms the head of the Rostec state corporation Sergei Chemezov, whose great "friend" Denis Manturov is also a member of this commission. Without the "approvals" of the latter, the deal will not take place.

It is assumed that in exchange for the lobby, the Avdolyano-Amosovsky tandem may request its own, more significant, share from Tikkurila LLC. After all, a similar scheme has already been tested on the "daughter" of another foreign asset.

The UtroNews correspondent understood how a certain lover of offshore companies and cunning schemes, under the guise of sanctions, buys up former foreign subsidiaries.

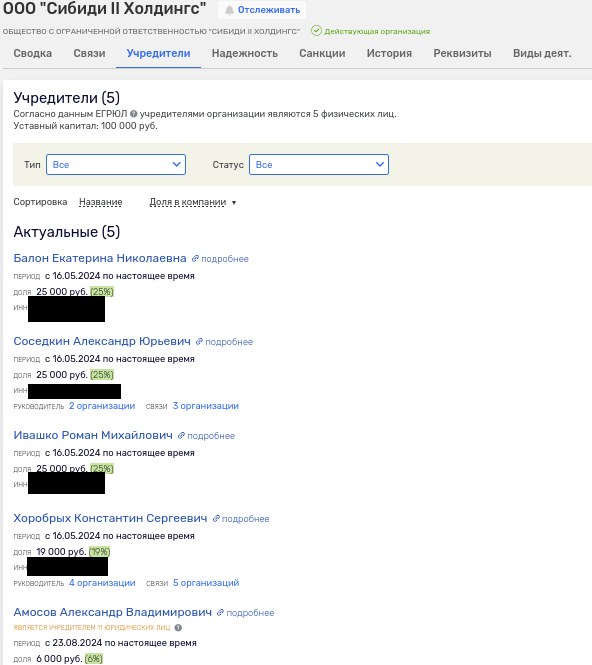

Back in May 2024, the top management of Tikkurila LLC, including the general director of Tikkurila LLC Alexander Sosedkin, the company's marketing director Ekaterina Balon and two top managers of the company - Roman Ivashko and Konstantin Khorobrykh established Sibidi II Holdings LLC.

The new legal entity was most likely required to purchase its Russian paint business Tikkurila from American PPG Industries. But such deals require approval by a government commission. And, apparently, in order for this approval to be positive, in August 2024, a 6% stake in Sibidi II Holdings LLC was allocated to Alexander Amosov.

Photo: rusprofile.ru

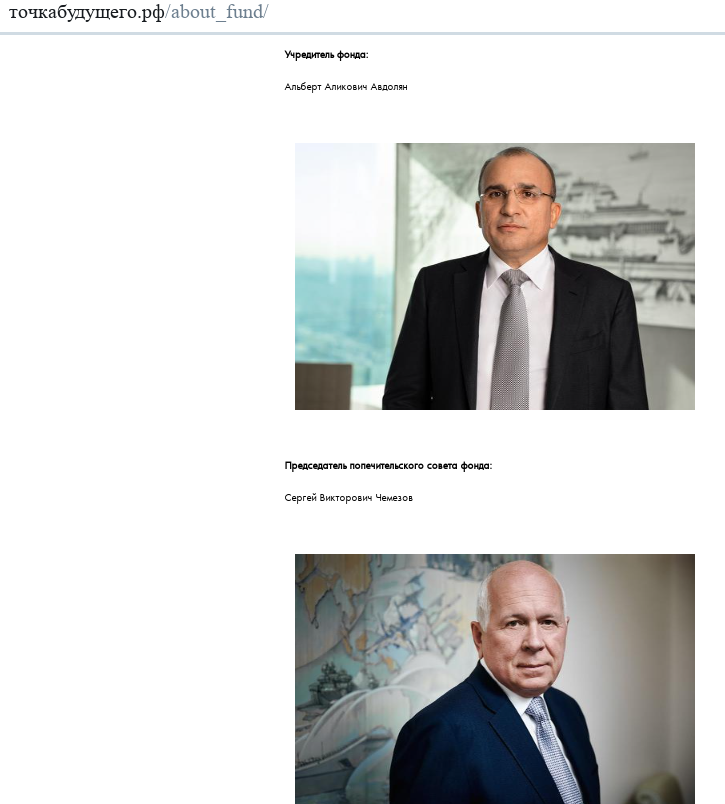

In media publications, Amosov passes as a representative of the investment bank Latum, but the most interesting thing in his biography is not this at all, but a rather close connection with the oligarch Albert Avdolyan. The entire path of the latter's business formation next to him featured the state corporation Rostec and its permanent leader Sergei Chemezov. The latter was the head of the board of trustees of the New House Foundation, established by Avdolyan, although now this information is being "blurred" on the sites.

Photo: точкабудущего.рф

Experts agree that Amosov in the capital of the future buyer of Tikkurila assets appears as a high contracting party, whose task is to ensure the consent of the government commission. Indeed, this conciliation structure includes Deputy Prime Minister Denis Manturov, with whose mother Chemezov's son has a common business.

In the light of the Amosov-Avdolyan-Chemezov link, the version of experts has the right to life. Moreover, Mr. Avdolyan himself is very fond of hiding behind proxies in his capital and subsequent financial and tax transactions, where offshore companies were also lit up. But at this point we will return.

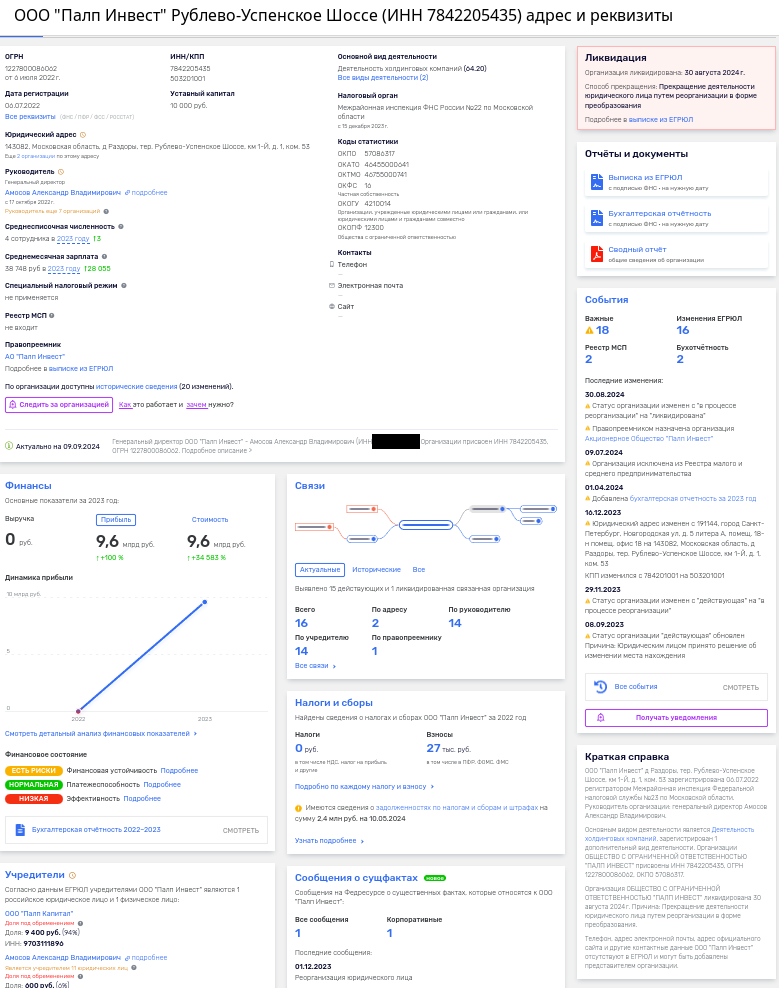

And earlier, Mr. Amosov, according to a similar scheme, has already become the legal owner of a stake in Pulp Invest LLC, which ceased to exist in August 2024, becoming a joint-stock company, which is likely to hide shareholders and beneficiaries.

In October 2022, the then created Pulp Invest, 94% owned by the general director of Silvamo Corporation Rus Timur Gabidullin, bought out the Russian assets of the American Sylvamo for $420 million. After the transaction, the company that produces SvetoCopy paper became known as NJSC Svetogorsk Pulp and Paper Mill (fresh shareholders were not disclosed). And with Gabidullin, Amosov remained the owner of Pulp Invest (Gabidullin was one of the owners through Pulp Capital LLC).

Photo: rusprofile.ru

The fact that in all these transactions Amosov may well represent not his own interests, but be a kind of screen for Avdolyan, indirectly speak numerous facts.

Amosov in the MRSEN case

The history of the collapse of the energy holding MRSEN (Mezhregionsoyuzenergo JSC) is associated with a high-profile criminal case on the creation of a criminal community, which allegedly brought about 10 billion rubles abroad. It was initiated in 2021.

The investigation believes that the money was stolen from electricity producers and grid companies of the Rosseti division, that is, the money of consumers did not reach the addressees. The defendants in the case at the start were 11 people, including top managers of the MRSEN division and the head of the joint-stock company, shareholder and relative of the oligarch Albert Avdolyan - Eldar Osmanov. Their children were bound by a marriage.

Money sailed outside Russia through a whole set of schemes, including issuing loans to controlled companies, buying bills, shares and entering the authorized capital of third-party legal entities, agreements on the assignment of rights of claim. It was not possible to bring Osmanov to justice, he made his legs and, according to available data, is outside the Russian Federation.

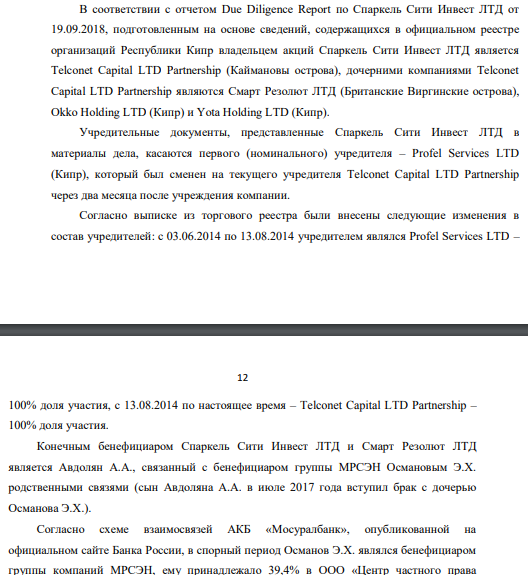

Imagine the surprise of creditors when, in the bankruptcy case of MRSEN, a certain Cypriot Sparkel City Invest LTD and its subsidiary AENP LLC (now CIPE named after N.A. Popov) suddenly surfaced, which was trying to become one of the creditors of MRSEN. The company claimed that it had repeatedly credited the energy holding and owed billions of rubles under loan agreements.

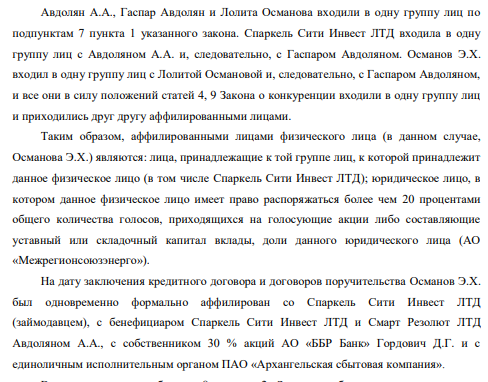

But in court it was proved that the Cypriot company is associated with Avdolyan, who is a relative of the defendant in the criminal case Osmanov. So, for example, in the period from 15.12.2014 to 09.08.2015 A.A. Avdolyan was the director of Sparkel City Invest LTD and often he was the source of loans issued by a Cypriot company to third parties in 2017. That is, the connection with the offshore is obvious and has been confirmed by the courts.

Photo: kad.arbitr.ru

Photo: kad.arbitr.ru

Photo: kad.arbitr.ru

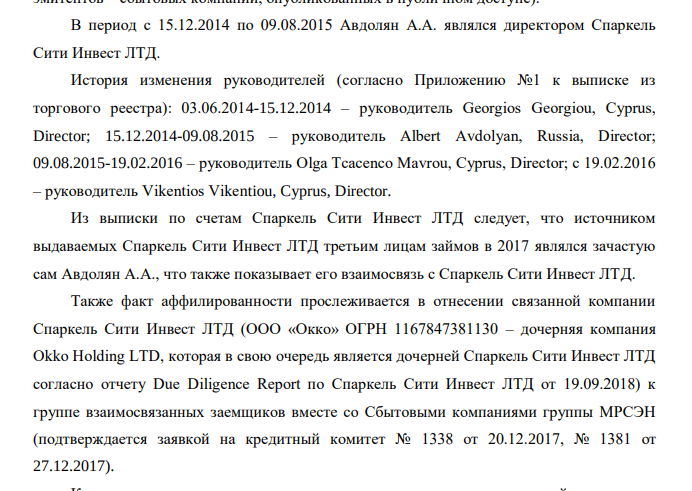

In 2023, Sparkel was removed from the number of owners of AENP. Apparently, so that affiliation is not striking.

AENP LLC, later renamed CIPE named after N.A. Popov, today belongs to the above-mentioned Alexander Amosov (share - 79%) and since February 2023 to a certain Latum LLC. The latter was established by the same Amosov and Alexei Bykov. At the same time, Amosov has been the owner of a stake in AENP since its inception (since March 2018), and Bykov has been a director since the same period. That is, their connection with the same Avdolyan is obvious.

By the way, Latum was eventually transferred to a certain NIV JSC, where the director is Bykov, and the beneficiaries are hidden. Under NIV, by the way, in 2024, legal entities were actively bought.

Another nuance: Bykov is a co-owner of Andayana Group LLC, and among his business partners is YATEK CEO Andrei Korobov. YATEK is part of the Avdolyan division.

In fact, in "AENP" after high-profile scandals with affiliation, only a rearrangement of terms occurred, from which the amount did not change.

Photo: rusprofile.ru

But this is far from the only thread of communication between Amosov and Avdolyan.

Stavropol history with a billion minus

UtroNews previously told in detail how the Stavropol enterprises were bought up and brought to collapse - OJSC Hydrometallurgical Plant, CJSC Southern Energy Company and LLC Intermix Met.

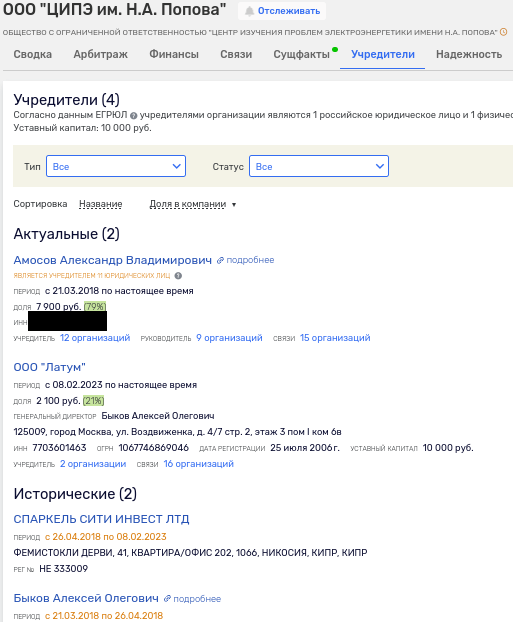

The buyer of assets in 2018 was Avdolyan's proxies, and he himself remained behind the screen. Later, the courts repeatedly proved affiliation and in the case file it was directly indicated that the beneficiary was Avdolyan, and Korobov was only a formal buyer of the plant's shares.

The court materials also reported that the new beneficiary organized a model of production activities of GMZ OJSC, which is in bankruptcy proceedings, by shifting the risk part ("center of losses") to it with the separation of the "profit center" concentrated on Cashmere Capital LLC. The court materials bluntly stated: organized by the beneficiary of the transactions Avdolyan A.A. at the facilities of GMZ OJSC, the tolling scheme provided Cashmir Capital LLC with revenue in the amount of 9.447 billion rubles. from the sale of products produced by the plant.

Photo: ras.arbitr.ru

Now let's go back to Mr. Amosov.

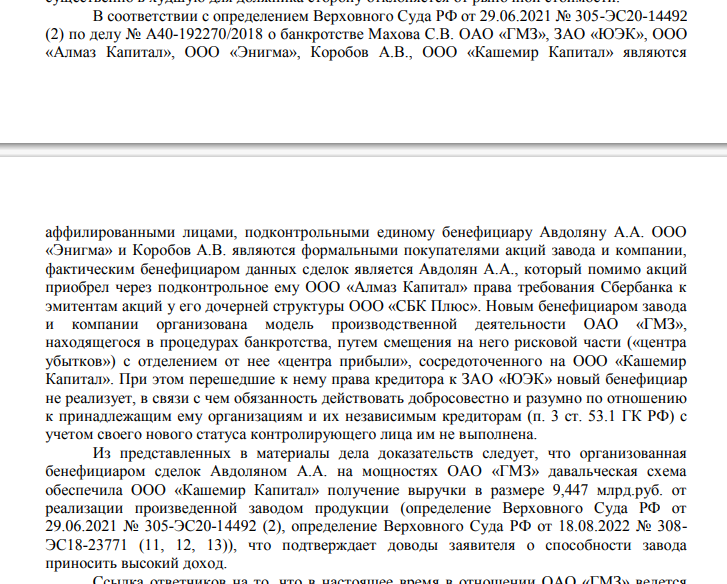

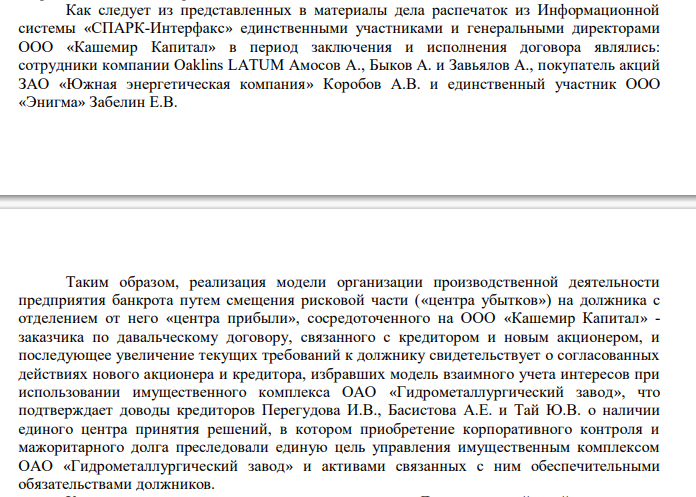

In the materials of cases related to Stavropol assets, it was noted that the only participants and general directors of Cashmere Capital LLC during the conclusion and execution of the contract were employees of Oaklins LATUM Amosov A. (!!!), Bykov A. and Zavyalov A., buyer of shares of CJSC Southern Energy Company Korobov A.V. and the only participant of E.V. nigma "Zabelin E.V..

The same materials clarified that at a certain period Amosov was elected to the governing bodies of the GMZ. Thus, Mr. Amosov also appeared in this story of Avdolyan, which confirms their strong business connection.

Photo: ras.arbitr.ru

Both stories involve dodgy financial schemes that raise numerous questions in the courts.

Moreover, offshore companies are actively flashing in Avdolyan's affairs. Offshore companies in the companies where Amosov appeared are also commonplace.

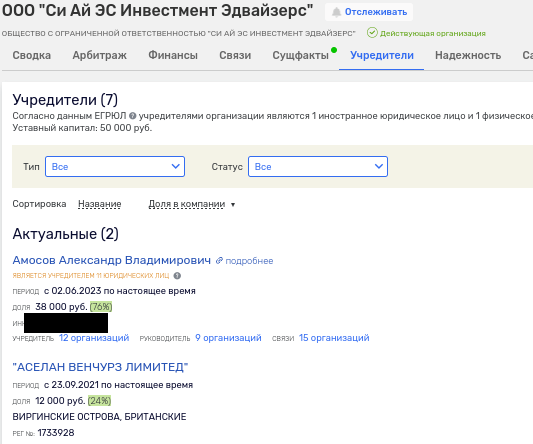

In addition to the above, AENP, a similar structure appeared in Sea Ai ES Investment Advisors LLC.

Amosov owns the company, bought in 2023, together with ASELAN VENTURES LIMITED, which is registered in the British Virgin Islands and, of course, the beneficiaries are hidden. Look for money from numerous transactions in the accounts of these firms?

Photo: rusprofile.ru

An interesting fact: in 2022-2024, Avdolyan actively left the companies once associated with him (possibly nominally), but proxies, including Amosov, actively stamped new legal entities. For example, in April 2024, Amosov established Intrada Holding LLC, in 2023 - Legato Holding LLC and Legato Investments LLC.

All firms are created for the subsequent management of certain holdings. So maybe Avdolyan, through a confidant, put a kind of conciliation lobby on stream, making this an additional source of income?

Читать на "The Moscow Post"