From the history of the ruin of Stavropol enterprises, the real beneficiary of which behind a screen of their faces was the oligarch Albert Avdolyan, smelled like a hint ...

In the history of the ruin of OJSC Hydrometallurgical Plant and CJSC Southern Energy Company, new details have appeared related to the settlement agreement, to which there are questions.

In court, it turned out that the debt document was pulled out from under the floor when, by a court decision, Avdolyan's team lost control of the assets. At the same time, enterprises allegedly must return the billion-dollar debt by the end of November 2024.

What else is happening in the history of strategic enterprises affiliated with each other in Stavropol, the UtroNews correspondent understood.

Recall that in 2016 a credit line is opened at Sberbank. Related CJSC Yuzhnaya Mining and Chemical Company (CJSC YUGHK), ZA Yuzhnaya Energy Company (YUEK), Intermix Met LLC, OJSC Hydrometallurgical Plant (GMZ) and a certain LLC "Selkhozkhimprom." At the time of the loan, the beneficiaries of the firms were Sergey Makhov and Sergey Chuck.

By 2018, the amount of debt only for this loan exceeded 311 million rubles, but in fact it was already about more than 1 billion rubles. Later, the creditors of Chuck and Mokhov will declare that they brought the company to the pen and there was a misuse of credit money, that is, they allegedly withdrew the loan money and do not intend to return it.

The court referred to the materials of the tax audit that GMZ OJSC and its counterparties created "a formal document flow in the absence of real relations through coordinated and deliberate actions of unity, interconnection and interdependence of all participants (links) of the created scheme for the purpose of illegal application of tax deductions for value added tax." In addition, later the former director of the GMZ Alexander Parshin was convicted of tax evasion and again it was a fictitious document flow.

Photo: ras.arbitr.ru

In 2018, when the amount of debts reached almost 1.5 billion rubles, Avdolyan's team appeared on a white horse, having bought the right to claim the debt. Initially, it was about Almaz Capital LLC, which was the assignee for a debt of 1.488 billion rubles.

Repeatedly in court it will be mentioned that, although the firms that appeared in the history of the ruin of GMZ, YUEK, legally belonged to different individuals, but in fact the oligarch Albert Avdolyan was the beneficiary. It was noted that in 2018 he bought out both the majority stakes in legal entities belonging to the group Makhova S.V. and Chuck S.V., in particular, shares of ZAO YUEK, and the rights of claim to this group belonging to Sberbank, having the opportunity to control it both as the main owner of shares and as a majority creditor.

Photo: ras.arbitr.ru

During the period when the team of Avdolyan, a big lover of offshore companies, "saved" Stavropol assets, new legal entities were created, under whose hat the enterprises worked. It was about Almaz Group, which included Almaz Fertilizer, Almaz Energo, Almaz Tech. The group also included Cashmir Capital LLC, which operated as the Almaz Fertilizer trading house.

From the bankruptcy case of GMZ, it became known that the structures controlled by the beneficiary (Avdolyan) implemented a certain tolling scheme by redistributing profits from the plant's activities in favor of Cashmere Capital LLC, while the current and registered debt of the plant (including to Almaz Capital) remained outstanding. This means that the purchased debts simply accumulated, overgrown with penalties and penalties, increasing the problems of companies and increasing their obligations to the oligarch's team. UtroNews spoke in detail about this scheme earlier.

Photo: ras.arbitr.ru

Back in 2022, a message appeared in the media from the press service of the oligarch that the assets were allegedly sold, and the "enterprise itself was lifted from ruins and nothing threatens it." In fact, judging by the materials of the courts, it was then that the transaction of the purchase and sale of shares of the same YUEK, carried out on the cheap and below the market price, was challenged in court by competitive creditors and the consequences of invalidity were applied. That is, in fact, Avdolyan's squires lost control of the assets in court.

Photo: ras.arbitr.ru

After that, in the bankruptcy cases of Stavropol assets, a kind of settlement agreement appeared, drawn up, in the opinion of creditors, outside the limitation period and without the necessary approval. By that time, the claimant had been changed to another company from the same division - Almaz Tech LLC. In the edition of 2023, Yuek, which is a heat supplier for consumers of Lermontov and only a guarantor for a controversial loan, it was proposed to pay off debts until November 23, 2024.

Photo: ras.arbitr.ru

The court directly stated that the settlement agreement fell after the loss of control and everything allegedly indicates "the dishonesty of the behavior of these parties aimed at obtaining debt and withdrawing liquid assets.

Avdolyan schematics: how the Hydrometallurgical Plant was heated

Photo: ras.arbitr.ru

Everything looks like that when access to the money of GMZ and YUEK was blocked, the cunning Avdolyanov guys went by collecting debt, which had previously been presented selectively and held until better times.

On the calendar, August 2024, both the arbitration manager and other creditors have so far managed to repel Avdolyan's co-company filing with their "amicable agreement."

In the history of the ruin of GMZ and YUEK, Avdolyan's proxies, who were participants in other dubious transactions, flashed more than once.

So, for example, the same company Almaz Capital, which has changed hands more than once, and at some point ended up with Alexei Bykov. He is directly related to AENP LLC (today - N.A. Popov CIPE LLC), which, under the sauce of allegedly issued loans, tried to become a creditor of the division of the bursting energy holding MRSEN. The beneficiary of MRSEN was businessman Eldar Osmanov, who was running away from the investigation - at that time a relative of Albert Avdolyan (by marriage of children). Both AENP and the related Cypriot offshore Sparkel City Invest LTD were torn and torn into the register of creditors of MRSEN, which looks like an attempt to withdraw part of the energy holding's assets to a controlled person. Nothing like that?

It is also interesting that in the GMZ deal there was a trace of Sparkel City Invest LTD, associated with Avdolyan.

By the way, the aforementioned participant in the tolling scheme, according to which billions left the accounts of GMZ, - Cashmere Capital in 2022 was transferred to a certain Almaz Tech LLC, co-owned by the aforementioned Bykov.

The share of the new owner was pledged by the BBR to the Bank of Dmitry Gordovich, which also repeatedly appeared in the ambiguous stories and schemes of Avdolyan. In particular, on the transfer to offshore firms of 100 million rubles to the Latvian bank JSC Citadele Banka.

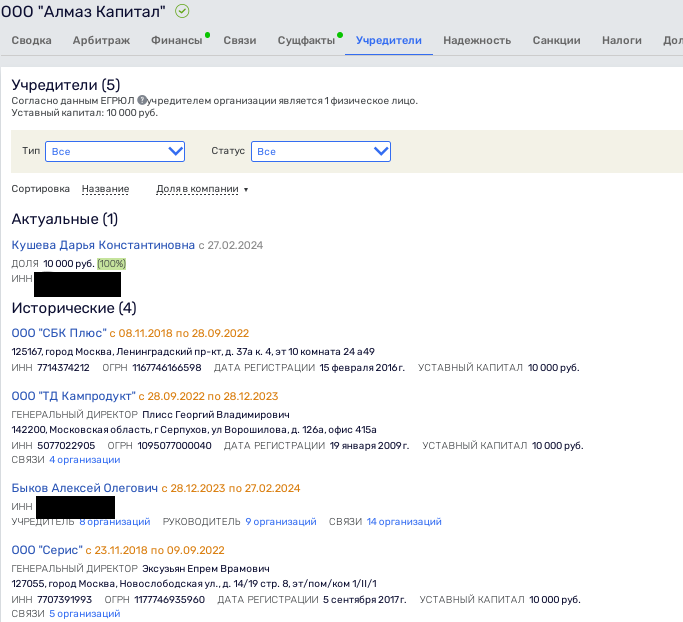

Today, the assets that were inherited in Stavropol history are transferred to persons who, at first glance, are not connected with the oligarch Avdolyan, that is, everything looks like an attempt to hide their tails in water. So, for example, Almaz Capital and Almaz Innovations LLC in 2024, as it were, sold to an unknown Daria Kusheva from St. Petersburg.

Photo: rusprofile.ru

At the end of 2023, Almaz Capital tried to bankrupt the tax authorities, but the case was dropped.

Probably, the debts of GMZ and YUEK will change the holder more than once. After all, the main claim of the courts is the affiliation of the creditor and the debtor through Avdolyan. But it is unlikely that the cunning team will be able to confuse the judges, but the attempt is not torture?

In general, history already smells well and, in our opinion, there is every reason to check the competent authorities of the actions of the oligarch and his team. Is there too much "awkwardness" in history with a dubious bias?

Читать на "The Moscow Post"