Structures close to the controversial businessman Oleg Belay continue to buy up assets. This happens at zero revenues. Where does the money come from, and where does it g...

Softline, through a chain of legal entities, according to media reports, indirectly controlled by Oleg Belay, wants to acquire the seller of Forward Leasing gadgets.

Until recently, Softline was controlled by its founder Igor Borovikov. But in April of this year, it came under the management of ZPIF Axioma Capital under the management of Tetis Capital.

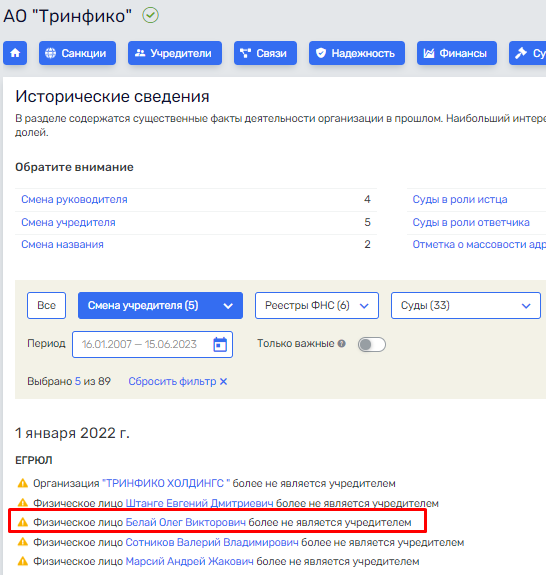

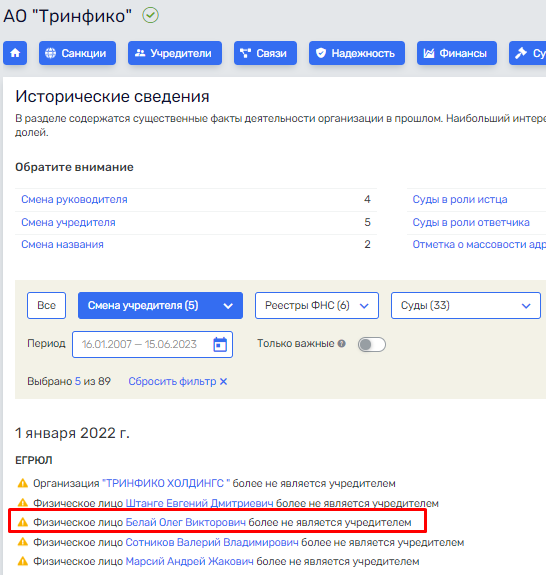

The latter, in turn, belongs to Trinfico JSC, the composition of the founders of which has not been disclosed. But it is known that until 2022 the company was controlled by Oleg Belay and other persons.

Photo: Rusprofile.ru

The most part of assets belongs to Belayu through "Trinfiko Holdings" which is included into LLC Trinfiko Group. In this chain it is easy to get confused. And journalists in 2023 were told that information isn't relevant, refusing to reveal owners.

Why Mr. Belay who, most likely, still remains the key beneficiary of all chain of firms decided "to withdraw" from attentive looks, also having made such large purchase as Softline and continuing "to broaden the empire" at the expense of Forward Leasing?

The correspondent of The Moscow Post understood a question.

Operation on "discharge" Softline?

You won't call Oleg Belaya the businessman with the cloudless biography. As well as Mr. Borovikov. There are bases to believe that the last sold the company to the first in order that not only to leave from different troubles. So more quietly.

We will explain. "Subsidiary" of Softline appeared in scandal with GIS energy industry – now because of not clearly where the spent several hundred millions the former deputy minister of Energy Anatoly Tikhonov gets acquainted with the criminal case file. Softline Trade was among the list of the companies which, according to the investigators, carried out contracts at obviously inflated prices. Though it wasn't proved, many still consider that Borovikov could "dodge" through "the" people in the structures able to influence the judgment.

Tikhonov's business still lasts and, perhaps, reported to Borovikov to begin to worry – here he, probably, and left, and Softline in Russia sold Belayu.

Flying over a nest White

This Mr., in turn, could be lit in the history with withdrawal of money from NPF Akvilon. The fact is that the KIT Finance Trade group to year in 2019 at inflated price sold the shares that Trinfiko taken in a repo that conducts to Belayu. Thus it was removed to 57 million rubles of pension savings – TASS reported.

The main shareholder of UK "Trinfiko" at that time was Serik Rakhmetov who worked in Transneft and Lukoil earlier. And in the last manipulations which usually regard as market deception were carried out too. The speech about scandal with the Cyprian broker Ronin Europe who, on probable conspiracy with officials of the company (in 2021 under house arrest on business the ex-employee of treasury of the company Aleksei Bessonov was sent), bought currency from Lukoil at lower price, than caused damage in 146 million rubles.

It is quite possible that, "having spotted" manipulations in Lukoil, Rakhmetov prompted the Belayu system.

The last had all opportunities to dip a hand and into Russian Railway "Blagosostoyaniye" fund: for "Trinfiko's UK" (through a number of structures also leading to Belayu) – the fund was called in 2021 "the anchor client". He made it or not it is unknown.

In 2011 the fund met difficulties with a conclusion of pension reserves from Industrial Traditions management company. The structure invested 14 billion rubles belonging to NPF - more than 10% of all pension reserves. As Kommersant wrote, as a result the Federal Service for Financial Markets forbade carrying out any operations with these assets.

Suspicion on withdrawal of funds?

The former partner White on Regionkonsalt Vladimir Nikitin suspected him of creation of the rival company by means of which that allegedly began to block activity of the agency, and actually deprived of an opportunity to win the auction on the large loan portfolios. The speech then went about LLC T-Capital – it then won the large contract instead of Regionkonsalt. So, fair "games", it seems, not in style of our hero.

Spitpoisons claim that allegedly Belay can "play" also policy. When between him and the governor of Zabaykalsky Krai Alexander Osipov in 2019. "The black cat" ran him TGC-14 company "accidentally" dispatched in media the whole detailed report about fake signatures for candidates for a governor's chair. Provoke such actions election pledges of Osipov to deal with problems in the power sphere could. And the TGC-14 "became famous" for economy on own employees to whom I paid 25 thousand rubles because of what those even went on hunger strike.

Not offshore, so fund

There is a wish to believe that Mr. Borovikov attentively got acquainted with the biography of the one to whom the child decided to sell the. Then it is improbable that he doesn't understand what can begin to happen to his former asset. As a part of founders of "Trinfiko Holdings" there was Cyprian "NIBRO CAPITAL MANAGEMENT LIMITED" until recently. Now he isn't so necessary – there is Aksioma Capital closed-end investment Fund. There will also settle means of Softline?

And it is the large company which is carrying out including state orders. At the same time, if to look at that how many revenues are generated by business White, there are many questions. There until recently was on zero (on zero was in April of the current year on indicators for 2022, but today Rusprofayl shows 83 million rubles for the same period – changes happened after the publication of article The Moscow Post "Software in "pipe": Белай will finish Borovikov's business?"

Photo: Rusprophile. Data as of April 7, 2023

Photo: Rusprophile. Data as of June 15, 2023

Maybe those who are supposed to do this will pay attention to Mr. Belaya?

Читать на "The Moscow Post"