The conflict between Alexander Mamut and German Gref could begin due to the fact that they allegedly could not "share" Nginx....

MigCredit Group of Companies became the largest private microfinance organization last year. As the correspondent of The Moscow Post managed to find out, the threads from it stretch to a conflict between the largest entrepreneurs and bankers of our country.

The names of the head of the largest state bank German Gref and the "toy king" Alexander Mamut are "shining" in history. Details - in the material of The Moscow Post.

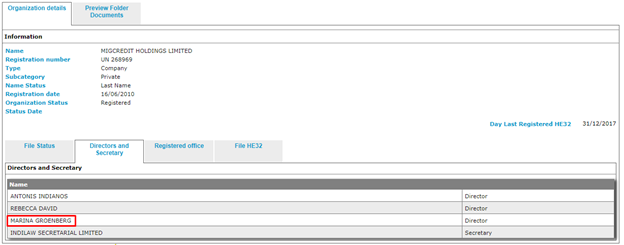

MigCredit is owned by Denum LLC, which, in turn, is registered with the Cyprus offshore MIGCREDIT HOLDINGS LIMITED. The board of directors of the latter includes Marina Grönberg.

Photo: https://efiling.drcor.mcit.gov.cy

The key beneficiary of MigCredit is businessman Alexander Mamut, known as the owner of the Hamleys chain (a business related to the sale of children's toys).

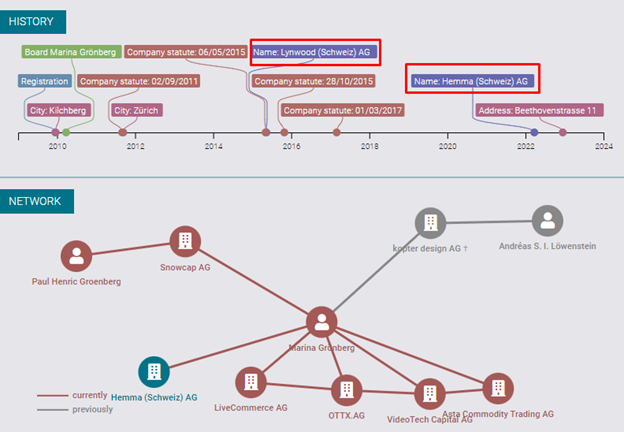

Marina Grönberg, a citizen of Switzerland and Sweden, heads the Hemma Group. This office was formerly called Lynwood.

Photo: https://www.northdata.com

It was yours - became ours

And it was Lynwood in 2015 that the rights (subsequently withdrawn) were transferred to protect the interests of the Rambler Group (at that time owned by Mamut). That is, the businessman, in fact, translated one of the key capabilities of the company into a kind of "left," but in fact, it seems, personal, office. It seems that already at this stage Mamut could be suspected of unscrupulousness, but for some reason this did not catch the eye of the future buyer of Rambler Group.

These rights were later used to prove the alleged infringement of Rambler's copyright by his former employee. And already when Mamut sold the asset. The copyright story is important for understanding the substance of the conflict we mentioned at the beginning.

Its essence is that Rambler employee Pavel Sysoev developed Nginx, and Rambler, when the latter "shot" and began to make a profit, decided that the company should have the rights to develop. More precisely, it was not Rambler that decided, but Lynwood, which filed a corresponding application with law enforcement agencies. It is difficult to explain what this is, if not an attempt to "squeeze" the development.

As a result, in 2019, Sysoev and a number of his colleagues even underwent searches. And then the interesting began.

"Rambler" disowned what he knew about Lynwood's plans. German Gref, the head of Sberbank, who had bought half of Rambler from Alexander Mamut shortly before, said that Rambler had not notified Sberbank about the conflict situation when selling the asset, although it should have. It seems that someone just looked poorly at the documentation, or maybe he knew knowingly about such an outcome, but did not do anything?

It seems that all persons associated with the state bank tried to abstract to the maximum from history in order to shift responsibility for what was happening to Grönberg, and through it, probably, Mr. Mamut.

There is a feeling that Mamut tried to circle Gref around his finger. Having transferred the rights of claim in advance to a probably affiliated company. So "Rambler" seemed to remain out of business and, accordingly, did not receive anything. And it seems to have provoked Mr. Gref's righteous anger.

On the other hand, the question arises: could the head of the state bank be unaware that the company he bought back in 2015 was preparing the ground for an attempt to "seize the hands" of Sysoev's "brainchild"? Perhaps he and Mamut just didn't agree on the price?

Male divorce

As a result, Gref apparently decided that the case had not burned out, and Rambler turned to law enforcement with a request to dismiss the case filed against Nginx at the request of Lynwood, although he did not immediately decide that he would abandon his own claims on the company. Later, German Gref personally met with Sysoev, they reached some agreements, and the court dismissed the case for lack of corpus delicti.

During the same period, Rambler "fell out" with Lynwood, terminating the contract with the company to protect the last interests of the company. But Mamut, it seems, decided not to stop and Lynwood filed a lawsuit against the owner of Nginx American F5 Networks, Nginx itself, its co-founders Igor Sysoev and Maxim Konovalov, as well as investing in Runa Capital and E.Ventures (who invested in their founded to promote NN ginx office). As a result, the court naturally refused them and the case faded.

Later, Hamleys Mamut tried to expel on a formal basis (due to the fact that the price policy of Hamleys ceased to correspond to the level of this object) from the Central Children's Store (CDM, formerly Detsky Mir), where they occupied the area. Recall that the shares of Detsky Mir are owned by Sberbank. The gesture is very eloquent

Chosen by bankers

Mr Mamut also has another "spike" with big financiers. Through the same "MigCredit": the company was the founder of the now liquidated due to re-registration in the SRO "MIR" NP "MIR." Also a microfinance counter, which, according to RBC, "represents and protects the general property interests of microfinance organizations, coordinates their entrepreneurial activities, and assists microfinance organizations that are members in expanding and developing microfinance activities."

A funny coincidence - one of the main faces of the company was Mr. Mamuta - Mikhail Valerievich. He also worked at the Central Bank during the period when he was chairman of the NP council.

First, in the positions of the head of the Main Directorate of the Microfinance Market and the methodology of financial inclusion of the Bank of Russia. Then he went to the heads of the Service for the Protection of Consumer Rights and Ensuring the Availability of Financial Services of the Bank of Russia. And subsequently became a member of the Board of Directors of the Bank of Russia.

Thus, it turns out that Mamut at least had direct connections with the Central Bank. Did they help MigCredit to become the leader of the segment?

At the same time, judging impartially, relying on the financial indicators of the company, there is no need to talk about its excellent position in terms of sustainability. According to Rusprofile, the organization is dependent on third-party creditors. It has a risk of loss of independence, a high share of borrowed capital and there is a risk of loss of independence.

And after the re-registration of the NP in the SRO and the appointment of a new person to the post of head of the company - Eduard Harutyunyan, a flurry of criticism fell upon it. Allegedly, the results of the work did not satisfy the regulators. Later, the leadership changed there - Elena Staratyeva became the main one. Also leaving the Central Bank, and the claims "disappeared."

Relying on bankers in their work seems to be Mamut's chip. But greed in such cases can be expensive. An hour is not even, they will give the command to raise the "lowdown" lover of children's toys. And there are many scandals there. What is the story with Investpro worth.

The owner of this company was the offshore Accles Holdings Limited, which owned almost 7% in Otkritie Holding. And until 2017, the same offshore belonged to Alexander Mamut himself. In 2018, FC Otkritie tried to get 4.7 billion rubles through the Moscow Arbitration Court, which Investpro allegedly owed, but Mamut had already sold the offshore at that time, and nothing could be recovered from it. Although it seems that billions "sailed" into the "cube" precisely with him. The Moscow Post detailed this and other stories surrounding Mamut's personality.

After such situations, the cooperation of bankers with the entrepreneur suggests that they themselves may not be clean in hand. Otherwise, why do they need a comrade in business who can "throw out" another such "fintile." Which seems to have happened in the story of Nginx, and as a result, neither Gref nor Mamut received anything, and the first also "stained" his reputation.

Читать на "The Moscow Post"