In the story of the alleged raider seizure of Wildberriz, the interests of the largest creditors of the parties could converge: VTB and Alfa-Bank, people Andrei Kostin an...

The scandalous story continues with the alleged attempted raider seizure of the largest Russian Internet marketplace Wildberry. Details - in the material of the correspondent of The Moscow Post.

On the eve of the spouse of the owner of 99% "Wildberriz" Vladislav Bakalchuk said that Tatiana left the family back in March of this year, and now it was influenced by one of the possible beneficiaries of the Russ Group, its head Robert Mirzoyan.

Bakalchuk claims that since the beginning of July, Wildberriz's assets have hastily passed into the wrong hands through Russ Outdoor (Russ Outdor) through "legal fraud". In his opinion, the deal to merge Wildberriz and Russ Outdor is unprofitable for his family, and his wife's new partners have bad intentions.

He made such statements at a meeting with the head of Chechnya, Ramzan Kadyrov, with whom they have known for about 10 years. In response, Ramzan Akhmatovich said that he knew that the levers of this "raider process" were in the hands of the Levan brothers and Robert Mirzoyanov.

Among other things, he instructed the authoritative State Duma deputy Adam Sultanovich Delimkhanov to tackle this issue. The head of Chechnya rarely connects such "heavy artillery", so the situation should really be very serious - so much so that Vladislav Bakalchuk himself does not really believe in the possibility of solving it through an appeal to law enforcement agencies.

Assets back and forth

Vladislav Bakalchuk owns 1% of Wildberriz, but during divorce proceedings he can claim half of the jointly acquired property. The court may recognize Wildberry's assets as such, because the spouses allegedly did not conclude a marriage contract.

Tatyana Bakalchuk herself gave an answer to the insinuations about being under the control of Robert Mirzoyan. According to her, this is not a raider seizure, but a divorce. I.e. Bakalchuk could hint that Vladislav simply does not want to accept her departure from the family and, perhaps, wishes herself more "compensation". Bakalchuk claims that he acts independently and consciously, and Vladislav himself previously supported the idea of combining Wildberriz and the Rus Group.

Note that this deal caused a lot of questions on the market. Its goals were not entirely clear - the largest Internet macro-place and one of the outdoor advertising operators "Russ Autdor" practically did not intersect in the market. What Wildberry can get is not entirely clear, but Russ can get the company's gigantic logistics capacities, the total cost of which can exceed 200 billion rubles.

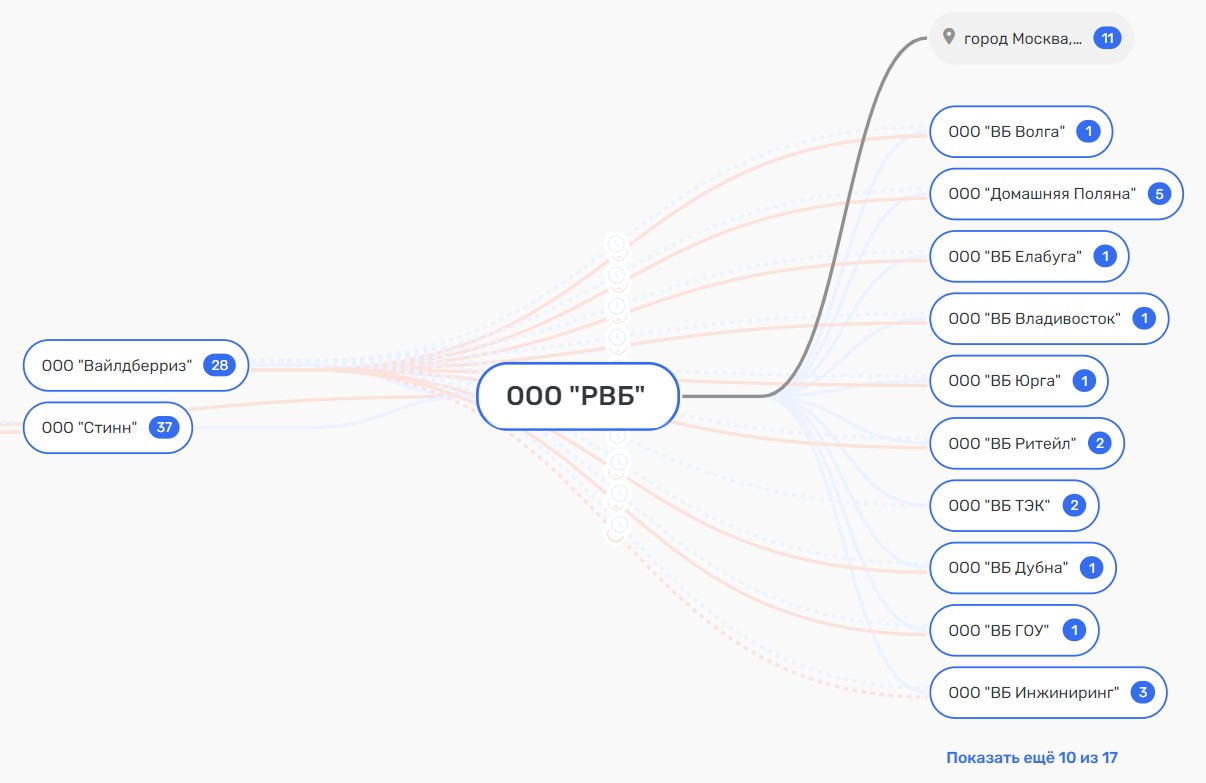

As Bakalchuk said, Wildberry's assets are allegedly being withdrawn from the company. The joint venture Wildberriz and Russ Outdor was named RVB LLC, 65% in it was received by Wildberriz LLC, another 35% for Stinn LLC. And here the big question is about the profitability and proportionality of such a "combination." After all, the turnover of the Russ business itself is almost ten times less than that of Wildberry. Why then in RBV they immediately received 35% through Stinn LLC, and, say, not 10%?

Photo: Rusprofile.ru

The words that Wildberry's assets are being withdrawn from the main legal entity of the group are confirmed. At the moment, 17 subsidiaries of the Internet marketplace engaged in logistics have already been transferred to the new "RVB". At the same time, it was not Bakalchuk who became the general director of the RVB, but Robert Mirzoyan, who is also the general director of Stinn LLC and Russ Outdor LLC.

The owner of Wildberry claims that this is a temporary solution. Mirzoyan became the general director, because she allegedly could not sign documents with herself. And after the end of the RVB unification process, she will head, and Mirzoyan will become the executive director.

Such an explanation is questionable. You can change the general director at the meeting of owners, where Stinn LLC has more than a third of the shares. At the same time, according to the network, allegedly right now there is a process of hard dismissal of employees loyal to Tatiana Bakalchuk. And later she may be persuaded to transfer another part of the RVB shares to Stinn LLC.

And here Robert and Levan Mirzoyan in general, why are they trying to present them as the beneficiaries of Russ Autdor? Both brothers were the founders of Vera-Olympus in the past - it was this company that bought Russ Autdor that became the base for the advertising holding.

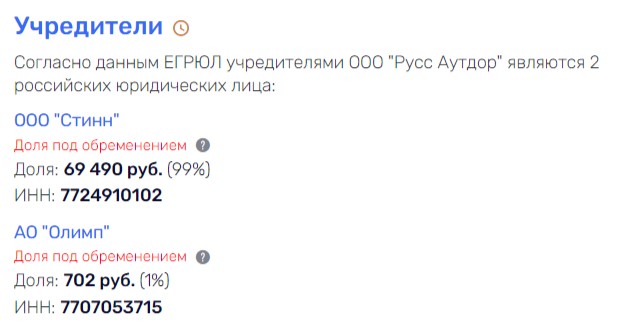

Now Russ Outdor is 99% owned by Stinn LLC, which until 2017 belonged to Robert Mirzoyan. Now the company belongs to Mirzoyanov's longtime partner Grigory Sadoyan, who can only be a nominal owner. And Levan Mirzoyan is not formally in the capital of close structures at all.

Photo: Rusprofile.ru

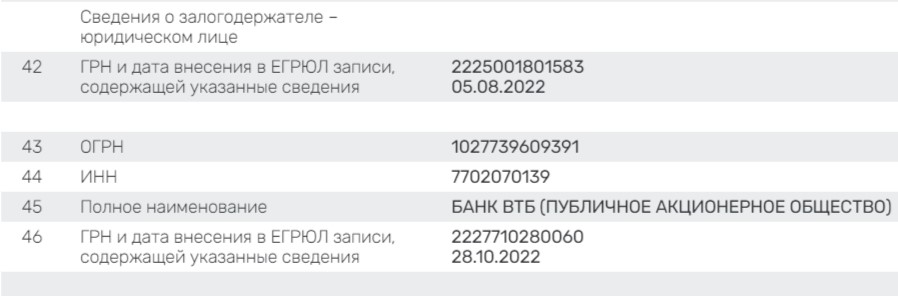

At the same time, the shares of Russ Autdor are pledged by VTB Bank. From 2022 to 2023, about 7% of Russ Outdor was for Shushary Holding LLC, a VTB Capital structure. It is logical to assume that the company is dependent on the opinion of the bank's management, in particular, Andrei Kostin - and he may also be involved in this story. Who gave Mirzoyans money for such large projects - and for what?

Photo: Rusprofile.ru

At the same time, Wildberry may be associated with the scandalous oligarch Mikhail Fridman. Tatyana Bakalchuk's company was credited to Alfa-Bank. And on June 6, 2024, this bank, together with Wildberries, held one of the largest CFA issues on the market for corporate and private investors.

Wildberries then placed digital financial assets in the form of a monetary claim for 3 billion rubles, for a period of 9 months and a fixed interest income of 17.5% per annum. The issue took place on the A-Token platform of Alfa-Bank, where the bank also acted as a consultant and organizer. Among the investors of the placement was Alfa-Bank.

I.e. the situation around the company may also be related to and dependent on the position of the two main creditors of the new structure - Alfa Group and VTB. And this can already become a "battle of the titans," where Mrs. Bakalchuk herself can be "ground". And whether people from Andrei Kostin's entourage might need Wildberriz - after all, they could "slip" Mirzoyan's idea against the background of large credit obligations related to him to the bank.

What "glorify" Mirzoyanov

In this context, Robert Mirzoyan and other figures close to him can only be executors of someone else's will. Well, if love intervened in the matter - i.e. there are rumors that Mirzoyan and Bakalchuk may indeed be in a close relationship - this is only a plus for a hot Caucasian businessman.

Robert Mirzoyan has always been the face of the family business, but Levan kept in the shadows, he is a non-public person. According to the network, allegedly both brothers are known for financial fraud and corruption schemes.

We do not undertake to assert, but a scandal is known when Levan Mirzoyan took out a loan of 5 million euros from Universal Finance Bank in 2014, and his brother acted as a guarantor. However, the loan was not repaid, a debt of 8 million euros was formed. As a result, the case was greatly delayed, according to the network, the court refused the bank in the claim. Was there any "schematosis" here?

At the same time, back in 2018, at the request of the DIA, the reporting of the bank was checked, which by that time had become bankrupt. The DIA considered the reporting to be fake, and the bankruptcy was deliberate. Can we assume that Levan Mirzoyan could help withdraw money from the bank?

Robert Mirzoyan. Photo: https://www.meme-arsenal.com/memes/1dbef0faeebfed14fd546ef8fa0db017.jpg

It is also interesting that in 2019 the court declared Levan Mirzoyan bankrupt and introduced a debt restructuring procedure against him. And this happened when he was just called the beneficiary of Vera Olympus, and the structure itself was close to buying Russ Autdor. Which subsequently happened. Could Levan Mirzoyan's bankruptcy be deliberate, fictitious?

Now Vera Olympus has been liquidated through the merger with Olympus JSC, one of the co-owners of Stinn LLC. At the time of liquidation, Vera had losses of 12 million rubles and a minus value of assets. Now, when it comes to merging with Wildberriz, Mirzoyanov is not expected to lack assets and profits...

Читать на "The Moscow Post"