It seems that the "brainchild" of Andrei Romanenko, according to Denis Dushnov and Ildar Akhmetshin, who participated in naked schemes, risks not surviving 2023....

"Kiwi-Bank" limited to 1 thousand rubles a month to withdraw funds and withdraw cash from customer accounts at the request of the Central Bank. According to media reports, the decision was caused by the Central Bank's claim to reporting and documentation.

This is not the first such case - in 2020, the Central Bank already limited a number of bank operations and fined it 11 million rubles. Details of the reason for this decision were not officially given, but experts say that the claims were related to payments to online casinos.

There is reason to believe that Kiwi Bank that then, what now, could have been caught in financial manipulations of a not entirely legal nature. Will the likely patron of the structure, German Gref, be able to "pull" his colleagues out of the next trouble?

Details - in the material of the correspondent of The Moscow Post.

Minus on the minus

Kiwi Bank is part of the Qiwi "empire" founded by Sergey Solonin, Boris Kim and Andrei Romanenko in 2007 after the merger of two payment systems - e-port and OSMP. Over the years, the structure has been overgrown with scandals and rumors, which we will talk about later, and first - dry statistics.

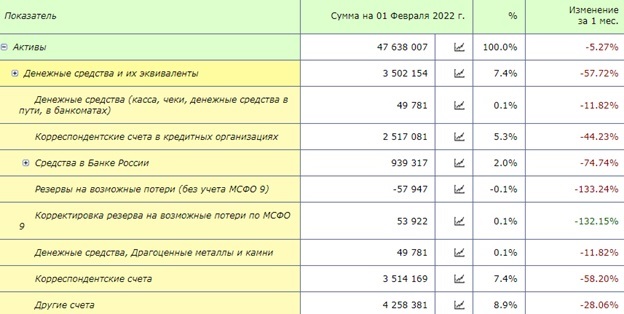

According to the service of banking analysts, in just a month (the latest available data date back to February 2022) the funds in Kiwi Bank decreased by 57%, at least the volume of reserves for possible losses fell by half, liquidity standards fell seriously.

Photo: https://analizbankov.ru

The independent financial statement even then stated that there were negative trends that could affect the financial stability of the bank in the future. Seven indicators of instability were identified. The question is - how did the bankers bring their brainchild to this position?

Generous commissions

Users were also not delighted with the work of the bank. On the forums every now and then there are stories about how Qiwi "legally" write off large amounts from accounts. According to the author of Phantom on the VC.ru platform, allegedly, after 30 days after the decision was made to terminate the contract with the platform, they took a commission of 0.5% of the balance on the account for each day when the money remained on it. And no one called about it, did not notify. Sites with reviews are full of other negative comments: they write mainly about the appropriation of funds and about ignoring customers and their problems.

At the same time, the very method of doing business can be far from legal. First, I want to say about the IPO - before the Kiwi shares went there, they were "warmed up" to impossibility, but later they began to fall steadily. Investors were hardly delighted, but Romanenko and his comrades should have earned well. After the recent news, Kiwi shares collapsed by as much as 6.5%. Who knows, maybe this is another attempt by the beneficiaries of the structure to earn money? But then you have to admit that the Central Bank is helping her. Of course, if the current "attacks" on the structure suddenly stop for no reason.

But there is another, more serious story in which Kiwi Bank plays one of the leading roles.

Nudity Empire

As Ildar Akhmetshin, a former partner and associate of Andrei Romanenko, told our publication, allegedly Kiwi served as a platform for Romanenko to cash out and sell funds. And he allegedly did this "in collaboration" with Denis Sugrobov, the former head of the main department of economic security and anti-corruption (GUEBiPK) of the Ministry of Internal Affairs, sentenced to 22 years in prison in 2017 for creating an OPS.

The very terminals where they can cash out. Photo: https://ya62.ru/news/society/v_torgovykh_tsentrakh_ryazani_poyavilis_poddelnye_qiwi_terminaly/

Such information was shared with other media by businessman Denis Dushnov, the former owner of payment terminals, whom Sugrobov once sent to jail.

According to Dushnov, the entire market of payment terminals was supervised by Sugrobov and his deputy, now the late General Boris Kolesnikov. And "Kiwi" in all this story was, as Dushnov said, the platform where "black" schemes were held for seven years. Dushnov himself also worked there, but at a certain moment he decided to separate and create his own network of terminals, then, according to him, the security forces took up him. This was told by "MK".

Around the same time, several other large cashiers went to jail, covered the Master Bank, which appeared in the schemes. This could be done in order to increase the interest on cash. Who benefited from it - obviously. Apparently, Sugrobov and KO went too far, not taking into account that someone should stand behind each cashier, so the landings and arrests began, and subsequently the disbandment of the Main Directorate of the Ministry of Internal Affairs in the Central Federal District. Romanenko could avoid this fate thanks to a serious patron, which we will talk about again.

At first, we only note that in 2015 the FSB searches were carried out in the Kiwi offices, but the case was not given a move then. And already in 2017, when Sugrobov's empire "fell", Romanenko formally left the management of the group, although, according to rumors, he actually remained at the helm.

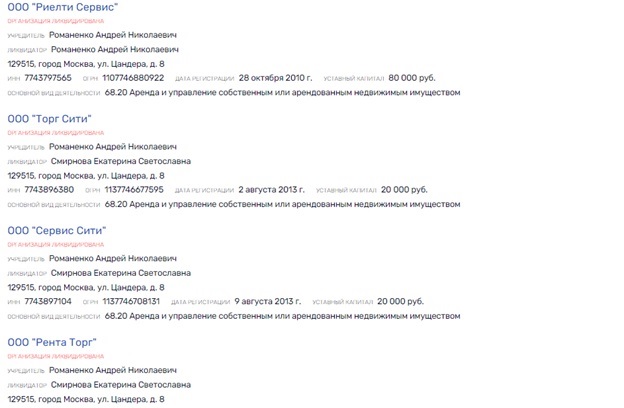

By the way, dozens of companies were registered for it at different times, most of which now do not exist. The revenue and profit of many of them for the entire period of existence was either at zero, or in the red. Were funds withdrawn from the cash desk through them?

Photo: Rusprofile.ru

By the name of Gref

Kommersant did not sit idle for long and almost simultaneously with the exit from Kiwi began to develop the company of online cash registers and cloud services for small businesses Evotor: and not one - the powerful state-owned Sberbank, headed by German Oskarovich Gref, became his partner.

The latter began to often flicker in the investigations of our publication in connection with the very strange transactions of Sberbank, which indirectly indicate that our respected banker may have chosen the path of not the guardian of the country's interests. Recently, the assets of the state bank, bought with state funds, are going to private traders. "Sberbank" makes strange purchases, as if in the interests of third parties. And so on and so forth. You can read about this in detail in our investigation "Gref and Kostin converged on Blazhko?"

Returning to Evotor, we note that the company has become very successful, grabbed a significant share of the public procurement market - including Sberbank among the customers. Already in 2019, the FAS drew attention to her, which issued a warning to the company due to the presence of signs of violation of competition law in its activities.

Online cash desk "Evotor". Almost no store can do without it today. Photo: Online-cashdesk.RF

The fact is that Evotor installed a software update on the CCT model of its production, after which the SIM cards of third-party mobile radiotelephone operators stopped working on these models of equipment.

As with "Kiwi", the structure soon became heard by the dissatisfied - on the Web you can find a lot of complaints.

But Evotor continues to work, and Kiwi Bank seems to be increasingly showing signs of imminent death. There is a possibility that they decided to carefully cover the structure at all, taking with them the funds of clients, to which they now do not have access. To remove Kiwi Bank is equally to some extent to clean up the reputation of Romanenko, as the new ally of German Gref, and give the way to his new beginnings - only people do not change, so history risks repeating itself.

Читать на "The Moscow Post"